Funding Update

Small business landscape

As the recovery from the pandemic continues business owners are faced with variances from input costs, fluctuating demand, late payments, government support and a rapidly changing lending market. This uncertainty is also being borne out in SME balance sheets.

Headline statistics from Experian Business Information team (the creators of the Commercial Delhi score) show businesses are under stress yet resilient:

- Small business average Commercial Delphi credit scores – down 9% on 2021

- SME lending on financial credit products remains below pre-pandemic levels

- While the arrears rate on pandemic loans is showing signs of stabilising, underlying arrears rates on other financial products are increasing

- Sharpest decline has been in new current account and loan volumes – mortgage and card lending is above pre-pandemic levels

- Just under 1 in 3 companies have fewer than 6 months’ worth of cash at bank – this has also held steady since earlier in 2022

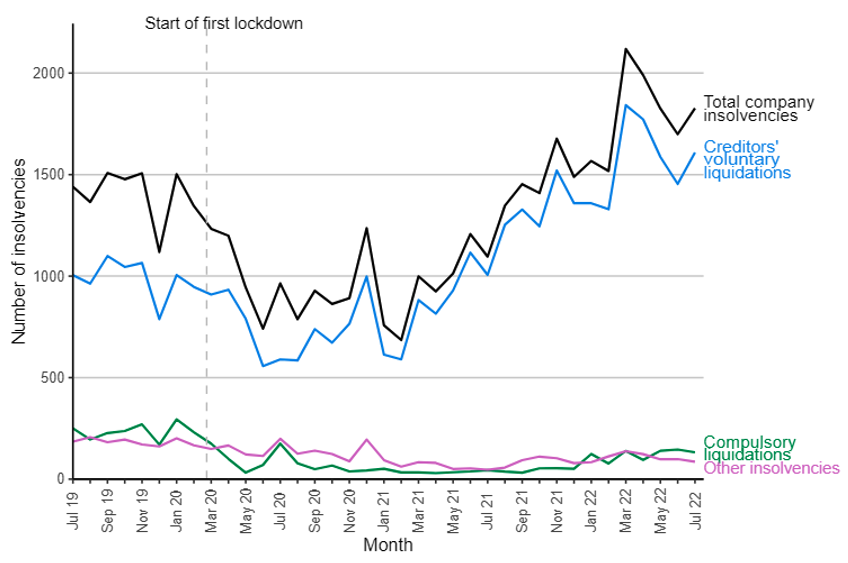

Insolvencies are rising but not yet extraordinarily:

Headlines from the Government Report in August 2022

- Company insolvencies in July 2022 was 1,827

- 67% higher than in the previous year (1,096 in July 2021)

- 27% higher than the number registered three years previously (pre-pandemic; 1,440 in July 2019)

Affordability and term duration changes

Impact on rising costs is affecting SMEs.

Affordability – the test of whether a business can repay their loan from their free cash flow – is now being applied more stringently in underwriting with the changing cost based for small businesses.

For example, businesses with notable energy or input costs are being stress tested for future rises therefore reducing a business’s ability to pass affordability tests and borrow higher amounts.

Any business looking to shore up their finances are looking at a cost cutting exercise as well as potentially lower offer amounts.

Shorter duration alleviating affordability

An alternative to alleviate affordability is of course longer durations however with credit risk rising lenders are actually more focused on shorter term products given the economic uncertainty.

Funding Circle and iwoca, for example, both now have short term products in the market and there are more coming. This can be good for businesses that can demonstrate high margins but tough for lower margin businesses.

Finding a flexible facility without exit costs may well be a solution for some businesses looking to mitigate the impact on their cash flow due to delay between Government support stepping in.

Recovery Loan Scheme (“RLS”) – a slow restart

The RLS 3.0 was announced in June 2022 yet in the middle of September there are only 16 lenders who are accredited and a handful that can accept applications. Of those, the RBS group makes up 5 (RBS, Bank of Scotland, Lloyds, Ulster and NatWest) and plus HSBC. Four more are regional lenders which could be a good option for specific businesses in those regions.

Five regional lenders accredited for RLS:

- BCRS – West Midlands and areas around Birmingham and Wolverhampton

- Coventry and Warwickshire Reinvestment Trust – Coventry or Warwickshire 😉

- First Enterprise – East Midlands and Southeast Midlands

- DSL Business Finance – Scotland

- Let us do Business – East and Southeast

And then there is Atom Bank, Tower Leasing, Shire Leasing and Genesis Asset Finance for secured options who are the only alternatives and are readily accepting applications. Plus, these are specialist lenders like UKSE (for the Steel industry).

The general appetite from the lending community has been to seek to revert to commercial lending terms. Given that the RLS 3.0 also includes a Personal Guarantee then it is likely that the difference for small businesses will be muted.

Capitaise’s estimate is that by around November 2022 the volume of “unsecured” lenders opens up applications for the scheme. However, the preference for lenders will be to flow applications into a commercial lending product rather than RLS.

It is worth noting that the total allocation of RLS 3.0 is just £2 billion which will need to be shared across all participating lenders.

Secondly the price cap of 14.9% against a backdrop of rising rates where “A” credit-rated businesses are nearing 9% then this will reduce the market where RLS can be made available to businesses. The recent Government budget (23rd September 2022) led to higher interest rates so few lenders may be able to get inside that APR cap.

All told, RLS 3.0 had been discussed throughout the community with the same expectations as the prior EFG scheme, present but rarely used. The foresight of the government for an emergency scheme in place is commendable. With 45% of SMEs at Capitalise indicating the need for funds is “Immediately” – time will tell if the execution matches the need.

A dynamic and vibrant alternative market presents many good choices for small businesses outside of their primary banking relationship.

However, with rates rising, and affordability constraints, RLS unlikely to make a significant difference in the market.

Capitalise’s recommendation is for businesses to think early about their funding requirements. As accountants, we are well placed to support businesses with good financial statements to understand their current position and of course project that out in the months ahead with rising sensitivity analysis.

Credit score requirements

Alongside affordability and RLS Capitalise is also seeing a small increase in the eligibility requirement for businesses. Since the lenders typically use Experian as their primary credit bureau in underwriting then it is highly recommended to check a client’s credit score before they apply to understand their eligibility.

Lending credit score requirements will vary based on lender tier and product type. Typically:

- Tier 1 bank lending – 60+ Commercial Delphi score.

- Challenger Banks and Alternative Lending 40+

- Business credit cards – 40+ Commercial Delphi Score (+Director score important)

- Asset Finance – 40+ commercial Delphi Score

- Invoice finance – CCJs and IVAs possible to fund, but debtors will require 45+

Below those scores there are options for trade credit but I also highly recommend their Credit Review Service to seek to improve a business’s score.

Three actions to help clients

Clearly at a time of rising costs and challenging revenue growth, good businesses may look to improve their working capital position.

The top three things Capitalise is seeing accounting firms do are:

- Cash forecasting and modelling in place to project cash utilisation

- Monitoring credit scores for changes to impact access to credit

- Applying early for funding to get more choices and often better rates

There will of course be rewards for businesses that come out the other side of this with a strong balance sheet as they look to increase market share, acquire or have improved margins in a more concentrated competitive market.

Monitor provides a way to understand your client’s eligibility using Experian’s credit scores. If you wish to learn more about it, please contact me awatkin@assyntcf.co.uk.